It used to be an unwritten law: the family doctor always gets paid first. After all, his achievements were particularly important, he was often something like a trusted family friend and people wanted to be on good terms with him just in case. Unfortunately, this has changed: Many GPs are also struggling to collect their fees, and it is not uncommon for them to have to resort to debt collection proceedings as a last resort – and these do not always lead to the desired result. This article provides a checklist for dealing with accounts receivable.

Family medicine practices are also increasingly struggling with delinquent payers and bad debt losses. Here is a checklist with tips and hints.

Creditworthiness check

Owning data shows how patients pay bills, so it should always be kept up to date. Various billing agencies offer credit checks, e.g., Ärztekasse, Curabill or Medidata. Health insurance companies will inform if someone is affected by a payment freeze. Clarify who will pay the bill (e.g., patient, health insurance, social services, accident insurance). Special care should be taken with unknown patients, out-of-canton patients or emergency consultations, and dispensing (expensive) medications, narcotics or similar substances. In these cases, request cash payment if possible. Only in emergency situations with the risk of harm to life and limb may the physician not refuse treatment.

Invoicing

Charge for services as quickly as possible (e.g. within 10 days). The sooner the patient receives the bill, the sooner he or she can remember the doctor’s visit. If the patient is unwilling or unable to pay the bill until after the health insurance company has paid him or her the reimbursement, no additional time will pass while you wait for payment. A clear indication of the payment deadline (e.g. “Invoice payable within 30 days”) creates the prerequisite for the reminder data and sends an unmistakable signal to the patient that he must meet his obligations.

Dunning

Regular checks should be made, e.g. once a week, to ensure that the fees charged and due have been paid. If the payment deadline is exceeded: send the first reminder within ten days. The “presumption of innocence” always applies. A friendly reminder will not annoy the patient. If payment continues to be outstanding, a second reminder should be sent after 20 days. As dunning practice shows, a third reminder is usually wasted effort. It is more efficient to threaten legal measures already with the second reminder. This way, precious time does not pass, during which the debtor’s financial situation may deteriorate further. If no specific payment date was set in the first reminder, a specific payment date must be set in the second reminder (e.g. within 14 days). If the payment is not received by 30 days at the latest, the threatened debt collection should actually take place.

Enforcement procedure

A debt collection is never initiated ex officio. It requires the impetus of the right-seeking creditor, in this case the family practice.

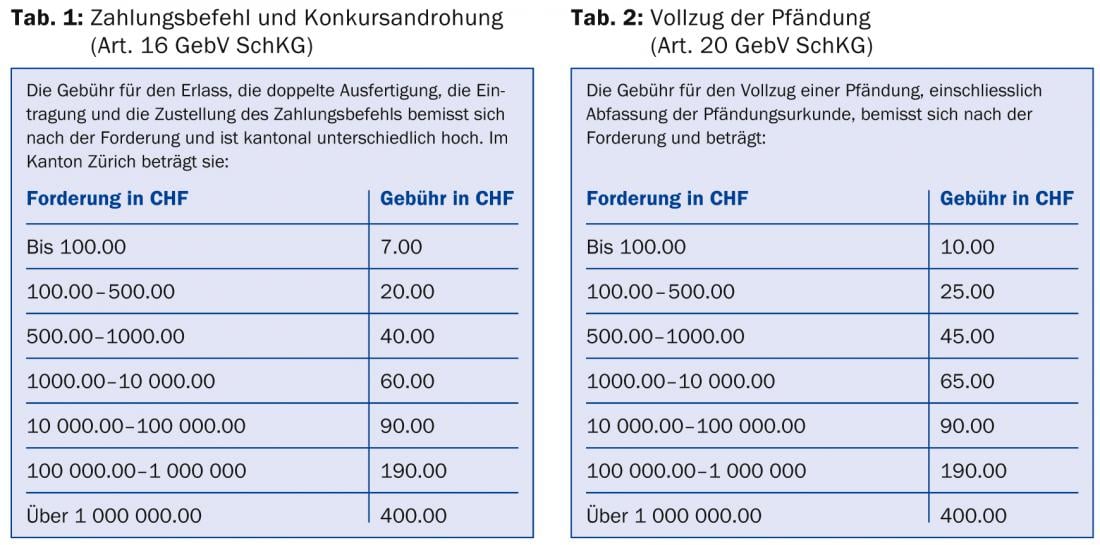

A debt collection must be applied for at the debt collection office. The creditor or his representative is required to make an advance payment (Table 1) .

The debt collection fees can be reclaimed in the course of the proceedings. If the debtor proves insolvent, the creditor loses the advance. This is also the reason why many creditors refrain from claiming smaller amounts by way of debt collection.

Upon receipt and payment of the debt collection request, the debt collection office shall issue the order for payment. It only examines whether the request is formally correct, not whether the claim made by the creditor is substantiated in terms of material law. The order for payment is therefore not an unconditional order to pay. It is the first step in the debt collection procedure and its purpose is to request the debtor to pay.

Even if the debtor knows that the claim is justified, he may oppose payment by filing a legal claim. There are many debtors who want to buy time in this way. Experience shows that when debtors have been playing for time and find that creditors are insisting on their claim, they often relent and pay.

Legal opening

As long as the legal proposal exists, the debt collection proceedings are at a standstill. The creditor must approach the judge within one year to remove the legal proposal. For this purpose, the creditor must submit evidence. Claims arising from medical fee invoices are regularly brought before the cantonal courts in the “ordinary course of proceedings”. The judgment rendered in the civil case authorizes the creditor to demand the continuation of the debt collection without further ado.

Attachment proceedings

After successful elimination of the legal proposal, the way to continue the debt collection is open again and the actual “enforcement procedure”, the attachment, begins. Like the debt collection request, the garnishment proceedings are never conducted ex officio. The creditor must expressly request the continuation of the debt collection and again pay an advance (Tab. 2). In the garnishment proceedings, the debtor must disclose his income and asset situation. The debt collection office requires a garnishment of the attachable income and assets.

The result can also lead to a “certificate of loss” if the debtor does not have sufficient income or assets. The creditor is thus left empty-handed and all collection costs are borne by him. However, the claim is subject to a limitation period of 20 years, whereas a fee invoice is subject to a limitation period of only five years.

Jörg Weber

HAUSARZT PRAXIS 2014; 9(3): 42-43